Merchant Power Plants

Bangladesh has experienced an average of 8% annual growth in CO2 emissions over the past two decades. The readymade garment (RMG) sector is the largest industrial contributor in CO2 emissions at 15.4%, followed by the textile sector at 12.4%. These sectors are not operating efficiently because of continuous usage of old and badly maintained machines coupled with poor energy management.

If the current industrial energy intensity persists along with the economic growth outlook in the medium to long term, Bangladesh will face severe difficulties in managing rising energy demands and achieving its GHG emission reduction targets under the Paris Agreement. However, textile and ready-made garments (RMG) manufacturers face several barriers to investing in energy efficiency including inadequate financial incentives, lack of technical expertise and the lack of an enabling environment. The sectors must overcome these barriers so that Bangladesh can meet its nationally determined contributions (NDC) target of 15% GHG emission reduction compared to a business-as-usual scenario by 2030.

The Programme provides an integrated package of concessional financing for textile and RMG manufacturers, and technical assistance to create an enabling environment and ultimately to reduce 14.5 million tonnes of carbon dioxide equivalent (MtCO₂eq) in emissions. This is facilitated through capacity building, awareness raising, policy development and support in loan disbursal, monitoring and evaluation of the programme parameters.

The concept of “merchant” plant financing emerged in the mid-1990s as a way to finance a power project with no revenue guarantees other than a projected market price at which the facility could sell electricity. Determining the future price of electricity quickly became a huge need in determining the viability of the project.

Projecting the future price of electricity is complicated and is dependent on many variables including: fuel prices, load growth, regulatory requirements, transmission constraints, performance of competing facilities, new technology, market liquidity and other factors.

Developers saw opportunities for projects, especially those based on state-of-the-art gas turbines that were designed to generate electricity at a lower cost than the competition, which would ensure a profit while selling power at market prices.

Since the market price and project revenues were not guaranteed, lenders needed extra assurance that the necessary revenues would be available to pay back the debt. To achieve this, the market risk was pushed back to the project developer through increased project equity, subordination of fuel payments, corporate guarantees and other approaches. Providing additional project support made it difficult for small developers to enter the market and large companies moved to the forefront in project development.

Since increasing the size of the project lowers the cost per kilowatt to construct, projects became larger during the late 1990s. From that period through 2001, project development focused on projects larger than most of the projects that were developed post-PURPA. There was also a trend to combine several projects into the same portfolio and finance them altogether, spreading the risk over several projects instead of one.

Under the portfolio approach, if a particular project fails to generate sufficient revenue, the remaining projects are expected to have sufficient margins to enable debt repayment. Financing numerous projects at the same time requires from several hundred million dollars up to $1-2 billion in capital. These capital requirements are far greater than a single, or even a few institutions, are willing to provide, thus more participants are required. As the number of participants increases, the complexity and difficulty of project financing does as well.

Key Characteristics of Merchant Power Plants (MPPs):

- No long-term buyer: Operates without fixed PPAs, selling power at spot market prices

- Price-based revenue: Earnings depend entirely on market demand, supply, and clearing price

- Higher risk, higher reward: Can earn more during peak price periods, but may suffer revenue dips when prices fall

- Grid-connected: These plants participate in the power exchanges like BEX (Bangladesh Energy Exchange) or PXIL

ExpoTech Renewable Energy Limited has received the400 MW (AC) NOC (No Objection Certificate) for Karerhat, Mirsarai, Chattogram which made the History in Bangladesh.

ExpoTech also received the245 MW (AC) NOC for Fatikcharri, Chattogram which is another milestone for Bangladesh and in the History of Chattogram and Bangladesh there had never been issued a 245 MW (AC) Solar Power Plants’ NOC for such a large area before. These are the locations we will install MERCHANT POWER PLANTS.

PPA v merchant What is right for your renewable energy project?

For developers of renewable energy projects, the traditional path to market has been to secure a Power Purchase Agreement (PPA) and raise non-recourse finance. The increasing scarcity of PPAs in the market and high forecast wholesale prices over the short term however, means that the economics, as well as the viability of ‘business as usual’ are being called into question.

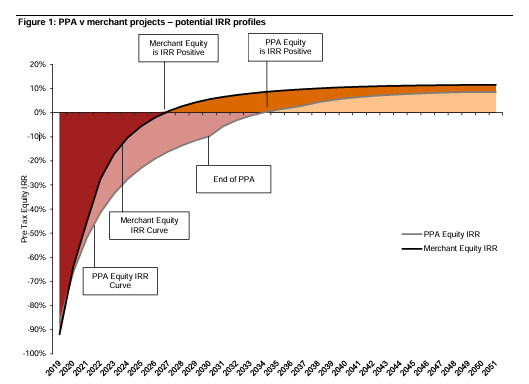

PPA v merchant—is the internal rate of return all that it seems? PPA projects have traditionally attracted a lower equity internal rate of return (IRR) compared to merchant projects due to the actual and perceived differences in risks. To understand whether a PPA or merchant arrangement is the right structure for your renewable energy project, it is important to explore the key differences between PPA and merchant project arrangements and the implications to the weighted average cost of capital (WACC). PPAs shift price and other risk from the generator to the off-taker for a predetermined amount of time. This provides medium to long term certainty of revenue and risk allocation, which is important for the project to attract commercial debt financing. In contrast, a merchant project will be subject to fluctuating spot prices and the full obligation of being a participant in the National Energy Market (NEM). In simple terms, when a project can transfer risk and secure cash-flow certainty, it should attract a lower WACC. This has been seen through PPA projects that are often geared at around 70-80 per cent with a relatively sharp equity IRR. Conversely, merchant projects with greater price and operational risk exposure struggle to raise debt and will therefore attract a higher equity IRR, resulting in a higher WACC.

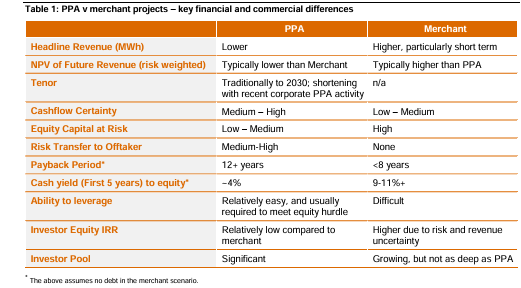

The table below presents some of the key financial and commercial differences between ‘typical’ PPA and merchant projects.

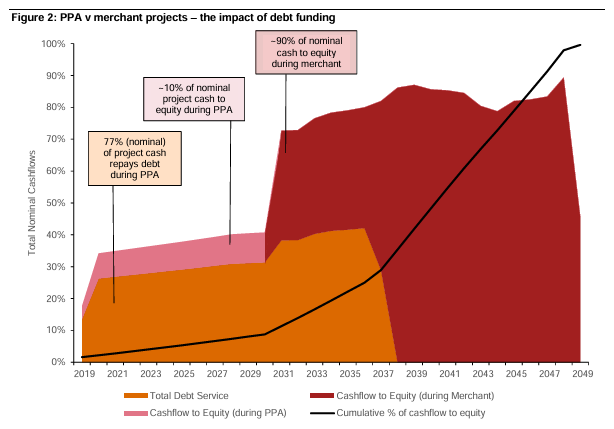

while the project is merchant (i.e. post the PPA). This brings into focus the relative IRR spread between contracted and merchant projects and the other upsides (current or future) from contracting. Figure 2: PPA v merchant projects—the impact of debt funding 100%, 90%, 80%, 70%. Total Nominal Cash-flows 60%, 50%, 40%, 30%, 20%, 10%, 0% ~90% of nominal cash to equity during merchant ~10% of nominal project cash to equity during PPA 77% (nominal) of project cash repays debt during PPA 2019, 2021, 2023, 2025, 2027, 2029, 2031, 2033, 2035, 2037, 2039, 2041, 2043, 2045, 2047, 2049. Total Debt Service Cash-flow to Equity (during PPA) Cash-flow to Equity (during Merchant) Cumulative % of cash-flow to equity PwC 3 May 2018 PwC 4. So the answer is don’t contract? Not necessarily.

When considering whether a PPA or merchant project is right for you, it is important to understand that there is a risk/reward trade off. This trade off cannot be assessed in isolation of a view on future wholesale prices. Running assumptions on the future can be particularly challenging with policy reform ongoing, and the outcome is likely to be material to future price directions. Despite this, the three main advantages PPA projects have over merchant projects are: 1 Price risk transfer.

A PPA will guarantee a project a price for a fixed period of time. Conversely, a merchant forecast by definition is a ‘best guess’ based on the information available at the time. This information is being shaped by regulatory/policy reform (and uncertainty) at various levels of government. The forecast is often made at a time when there are large numbers of announced projects (noting it is likely that many will never achieve financial close), and the changing implications of new and improved technology on these projects is still to be fully understood (including implications for storage). Many of these factors interrelate in their impact on pricing. Consequently, the price path (even in the short term) may result in an outcome significantly different than anticipated.

ExpoTech Renewable Energy Limited’s Board of Directors has passed resolution to establish Merchant Power Plants in all over Bangladesh and help the environment to have Greener Energy to save our FUTURE GENERATIONS. To save Bangladesh.