What Are Carbon Credits?

Carbon credits are certificates representing the reduction or removal of one metric ton of CO₂ or its equivalent (CO₂e) from the atmosphere. They are generated by projects that avoid, reduce, or capture greenhouse gas emissions and are used by organizations to compensate for unavoidable emissions as part of their climate strategies.

Why Companies Buy Carbon Credits?

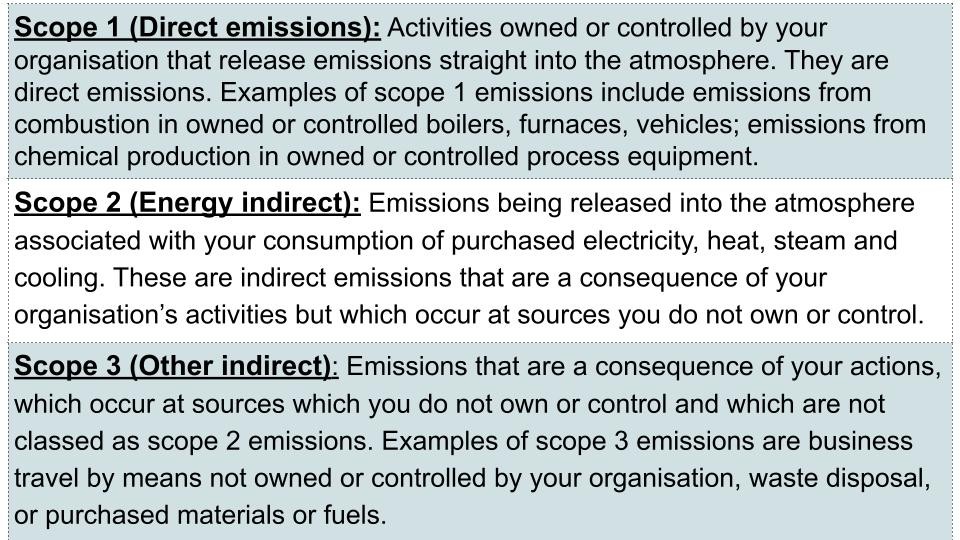

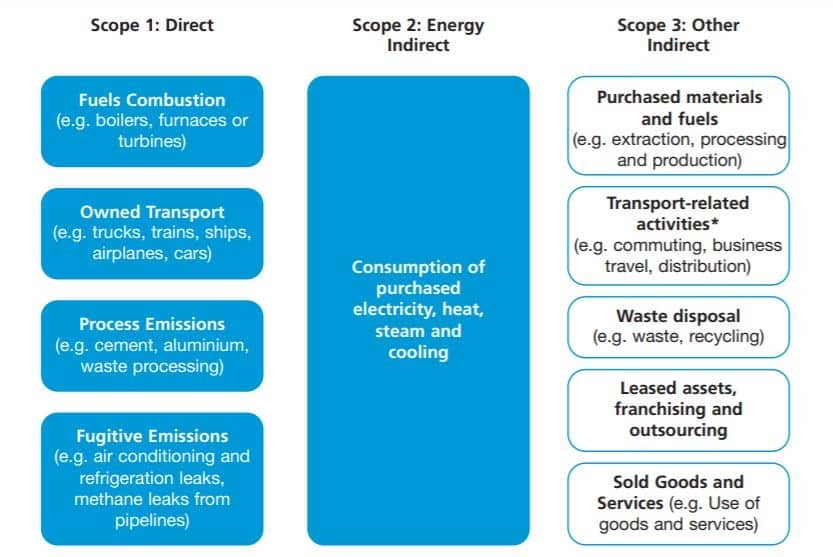

Carbon credits are used to compensate for unavoidable emissions, helping companies address Scope 1 and Scope 3 emissions. They play a key role in net-zero strategies, voluntary climate commitments, and ESG reporting, allowing organizations to demonstrate credible climate action.

Carbon Credit Project Types

We offer a wide range of high-quality carbon credits, sourced from certified projects designed to reduce or remove greenhouse gas emissions. These projects include:

Nature-Based

Includes forestry and land use projects such as REDD+, afforestation, reforestation, and soil carbon initiatives.

Energy Efficiency

Covers projects that reduce emissions through improved efficiency, including cookstoves, industrial upgrades, and similar solutions.

Renewables

Credits from renewable energy generation such as wind, solar, and hydro power.

Other Projects

Covers verified solutions like carbon capture and storage (CCS), methane capture, and waste management.

Carbon Credit Standards

All credits available through our platform are certified under leading international standards:

We exclusively offer high-integrity carbon credits that meet strict criteria, including additionality, permanence, and third-party verification. To explore detailed project types and categories, visit:

How to Get Started

You can source carbon credits directly through our Marketplace. Select your preferred project type, volume, vintage, and standard — or simply tell us your goals, and we’ll help you find the most suitable options for your climate strategy and secure the best available price.

Co-benefits & SDG Contributions

Many carbon credit projects contribute to Sustainable Development Goals (SDGs) by supporting biodiversity, community development, clean water access, and improved health. Selecting projects with specific SDG co-benefits helps organizations achieve broader environmental and social impact alongside carbon reduction. Our team can assist you in finding projects that match your sustainability priorities. Some of common SDGs linked to carbon projects:

Retirement & Claiming Process

To make a valid climate claim, carbon credits must be retired. Retirement ensures that the emission reduction is accounted for and cannot be used again by another organization. When purchasing through our Marketplace, we handle the retirement process and provide you with all necessary documentation for reporting and verification purposes. This gives you full assurance for audits, sustainability reports, and voluntary frameworks.

Gold Standard Carbon Offset Projects: Types and Benefits

Gold Standard was established in 2003 by WWF and other international NGOs to bring credibility to carbon markets through projects that deliver both climate action and tangible benefits for people and ecosystems. It was originally designed to certify high-quality renewable energy and energy efficiency projects, with a strong emphasis on sustainable development. Since then, the scope of Gold Standard has broadened significantly. Under its current framework the standard supports a wide range of climate and development interventions. Projects must demonstrate environmental integrity and deliver measurable contributions to the Sustainable Development Goals (SDGs), with co-benefits such as improved health, livelihoods, or ecosystem services forming a core part of the certification process. This guide summarizes the key project types eligible for Gold Standard carbon credit issuance. The standard itself does not rely on fixed groupings so the categories below reflect how these projects are typically understood.

They are grouped for clarity and aligned with common use cases and methodologies.

Project Type | Description | Examples |

Renewable Energy | Clean power projects in developing countries | Solar, wind, hydro, biogas, biomass |

Energy Efficiency | Projects that reduce energy waste | Cookstoves, insulation, LED lighting |

Waste Management | Capturing methane and converting waste into energy | Landfill gas, composting, wastewater, household, biogas |

Forestry & Land Use | Carbon removal through trees and smart land use | Reforestation, agroforestry, climate-smart, agriculture |

Community Projects | Improving health and quality of life | Clean water, solar lanterns, digesters |

Other Types | Specialized or micro-scale projects | Transport, buildings, micro-scale interventions |

Key Gold Standard Project Types

Renewable Energy

Renewable energy was the core of Gold Standard’s founding vision. The standard was originally created to certify clean energy projects in developing countries, with a dual aim: cutting emissions and delivering tangible benefits for local communities. Today, Gold Standard continues to support a range of renewable technologies: solar PV, wind farms, small-scale hydro, geothermal, and biogas. These projects displace fossil fuels and provide cleaner, more reliable energy sources in regions where access may be limited. Beyond emissions reductions, these efforts are often linked to broader goals. They improve air quality, create jobs, and provide better energy access for underserved populations.

Energy Efficiency & Demand-Side Management

These projects focus on reducing emissions by cutting energy waste at the source. Gold Standard certifies a range of efficiency-focused activities, from improved cookstove distribution to better home insulation, lighting upgrades, and streamlined industrial processes. What ties them together is their emphasis on practical, measurable energy savings. In many cases, the impact goes beyond carbon. Efficient cookstoves, for example, reduce indoor air pollution and ease the burden of collecting firewood, improving health and daily life in communities. For companies looking to support carbon reduction alongside broader social outcomes, energy efficiency and demand-side interventions offer a compelling route.

Waste Management & Biogas

Waste is a major source of emissions. To address this, Gold Standard certifies projects that turn waste streams into climate solutions by capturing methane or converting organic material into usable biogas. Eligible project types include landfill gas recovery, wastewater treatment, manure management, and composting. These initiatives prevent the release of methane, a greenhouse gas far more potent than CO₂. They also frequently deliver co-benefits such as improved sanitation and access to clean cooking fuel. In many cases, biogas systems supply renewable energy to households and communities, helping to improve health, reduce deforestation, and replace the use of fossil fuels.

Forestry and Land Use

Gold Standard has expanded its scope in recent years to include select forestry and land-use projects. While these project types were historically covered by other standards, Gold Standard now certifies activities such as afforestation, reforestation, agroforestry, and climate-smart agriculture. These nature-based solutions focus on removing carbon from the atmosphere through tree planting and improved land management. To qualify, projects must also deliver co-benefits such as improved livelihoods, food security, or ecosystem restoration. Agroforestry and sustainable agriculture practices fall under Gold Standard’s land use work. These projects are typically designed to balance carbon sequestration with long-term benefits for local communities and the surrounding environment.

Community-Based Projects

Gold Standard supports a range of projects that directly improve quality of life while reducing emissions. Clean water access is a key example. Water purification technologies eliminate the need for boiling, cutting wood fuel use and household emissions. Other community-focused efforts include the distribution of solar lanterns or small household biogas digesters, which bring clean energy solutions to off-grid or underserved areas. These technologies help reduce indoor air pollution, improve daily living conditions, and create meaningful co-benefits alongside climate impact.

Other Project Types

Beyond the core categories, Gold Standard also certifies a limited number of projects in areas like low-carbon buildings, sustainable transport, and aggregated micro-scale interventions. These project types are typically eligible when they demonstrate clear emissions reductions and meet sustainable development criteria through an approved methodology.

At the time of producing the bill, I am requesting the Secretary to get 25% for the People Republic of Bangladesh and 75% should be given to the respective Solar Power Plant owners. I like to mention that in all countries in the world, 100% Carbon Credit is given to the solar farms / plants. Bangladesh is only the exception.

Atmospheric CO2, CH4, SO2, N2O, etc. are mainly responsible for temperature increase resulting in the rise of sea level. Temperature rise by 1.00C would inundate 18% area of Bangladesh as indicated by different studies. At the same time, the country is affected frequently by flood, drought, cyclone, and salinity due to climate change. As a result, soil fertility, crop productivity, and food security would be seriously threatened. Climate change has also accelerated hunger, poverty, malnutrition and incidence of diseases, especially in developing countries (IPCC, 2007). It is basically the poor that would be worst victims of climate change. Profit driven mode of production by corporate agencies and their over extraction and consumption of fossil fuels (coal, oil) has also hastened global warming.

In Bangladesh, about 1 million hector of the coastal region is saline. But very few varieties are available for combating salinity. Drought affects annually 2.5 million hector in kharifand 1.2 million hector in dry season. Kharif drought affects T. amanrice severely. Besides, about 2.6 m hector are affected by flood in a normal year (Z. Karim, 1997). The devastating flood of 2004 inundated 40 districts and caused considerable loss of crops and human life. But very limited technologies are available that are tolerant to flood and drought.

According to Intergovernmental Panel on Climate Change (IPCC, 2001), coastal area of Bangladesh may go under saline water by 2050. Due to the rise in temperature, crop production will be reduced by about 30%. Climate change, especially temperature rise would decrease the yield of bororice by 55-62% and wheat by 61% by 2050 in Bangladesh (New Age, 2008). Frequent felling of green trees by the influentials, especially in coastal belts for building shipyards has also become a threat to climate change.

All the Solar Plants in Bangladesh will help the carbon emission. It is emphasized that mitigation measures rather than adaptation practices may be considered as better solutions to the problem. Mitigation measures include the use of renewable energy, reduction, and efficiency in the use of fossil fuels, afforestation, early warning system to disaster management, preventing felling of green trees, especially in coastal areas. The idea behind the creation of carbon credits is very simple. If an entity can’t avoid releasing CO2, it can ask another to emit less so that the total level of CO2 in the atmosphere is cut even if the first emitter continues on producing CO2.

What Are Carbon Credits?

Carbon credits are permits that allow the owner to emit a certain amount of carbon dioxide

(CO2) or other greenhouse gases (GHGs). One credit allows the emission of one ton of carbon dioxide (CO2) or the equivalent of other greenhouse gases. Carbon credits are also known as carbon allowances.

The ultimate goal of the carbon credit system is to reduce the emission of GHGs into the atmosphere and to decrease the carbon footprint.

How Do Carbon Credits Work?

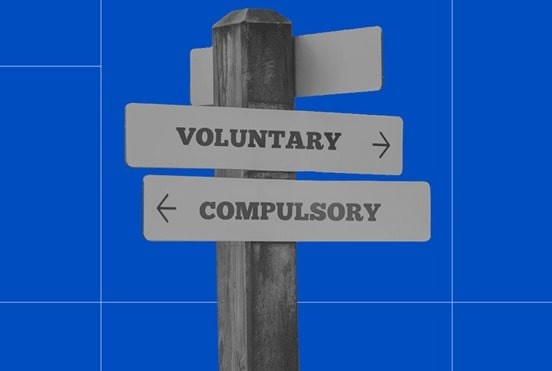

The United Nations allows countries a certain number of credits, and each nation is responsible for issuing, monitoring, and reporting its carbon credit status annually. Governments allow companies to emit a set amount of GHGs before needing to purchase credits.

If emissions exceed limits, they are required to buy credits.

If a company purchases too many credits, it can sell the excess on a carbon exchange or marketplace. This system is commonly called a cap-and-trade program.

The Kyoto Protocol of 1997 and the Paris Agreement of 2015 were international accords that laid out international CO2 emissions goals. With the latter ratified by all but six countries, they have given rise to national emissions targets and the regulations to back them. With these new regulations in force, the pressure on businesses to find ways to reduce their carbon footprint is growing. Most of today’s interim solutions involve the use of the carbon markets.

What the carbon markets do is turn CO2 emissions into a commodity by giving it a price.

These emissions fall into one of two categories: Carbon credits or carbon offsets, and they can both be bought and sold on a carbon market. It’s a simple idea that provides a market-based solution to a thorny problem. Bangladesh is way behind of this Carbon Credits both in collecting where Bangladesh is missing billions of dollars as well as crediting all the money or at least a fair amount (where I proposed a generous 75% for the Bangladeshi Renewable Energy Companies) to the Solar Power Plant companies.

What Are Carbon Credits and Carbon Offsets?

The terms are frequently used interchangeably, but carbon credits and carbon offsets operate on different mechanisms.

Carbon credits, also known as carbon allowances, work like permission slips for emissions. When a company buys a carbon credit, usually from the government, they gain permission to generate one ton of CO2 emissions. With carbon credits, carbon revenue flows vertically from companies to regulators, though companies who end up with excess credits can sell them to other companies.

Carbon Offsets flow horizontally, trading carbon revenue between companies. When one company removes a unit of carbon from the atmosphere as part of its normal business activity, it can generate a carbon offset. Other companies can then purchase that carbon offset to reduce their own carbon footprint. Note that the two terms are sometimes used interchangeably, and carbon offsets are often referred to as “offset credits”. Still, this distinction between regulatory compliance credits and voluntary offsets should be kept in mind.

How Are Carbon Credits and Offsets Created?

Credits and offsets form two slightly different markets, although the basic unit traded is the same—the equivalent of one ton of carbon emissions, also known as CO2e.

It’s worth noting that a ton of CO2 does refer to a literal measurement of weight. Just how much CO2 is in a ton?

- The average American generates 16 tons of CO2e a year through driving, shopping, using electricity and gas at home, and generally going through the motions of everyday life.

To further put that emission in perspective, you would generate one ton of CO2e by driving your average 22 mpg car from New York to Las Vegas. For Bangladeshi context, from Dhaka to Chattogram. Carbon credits are issued by national or international governmental organizations. I’ve already mentioned the Kyoto and Paris agreements which created the first international carbon markets.

What is the Carbon Marketplace?

When it comes to the sale of carbon credits within the carbon marketplace, there are two significant, separate markets to choose from:

- One is a regulated market, set by “cap-and-trade” regulations at the regional and state levels.

- The other is a voluntary marketwhere businesses and individuals buy credits (of their own accord) to offset their carbon emissions.

Think of it this way: the regulatory market is mandated, while the voluntary market is optional.

When it comes to the regulatory market, each company operating under a cap-and-trade program is issued a certain number of carbon credits each year. Some of these companies produce less emissions than the number of credits they’re allotted, giving them a surplus of carbon credits.

On the flip side, some companies (particularly those with older and less efficient operations) produce more emissions than the number of credits they receive each year can cover. These businesses are looking to purchase carbon credits to offset their emissions because they must.

Most major companies are doing their part and will or have announced a blueprint to minimize their carbon footprint. However, the amount of carbon credits allocated to them each year (which is based on each business’s size and the efficiency of their operations relative to industry benchmarks), may not be enough to cover their needs.

Regardless of technological advances, some companies are years away from reducing their emissions substantially. Yet, they still have to keep providing goods and services in order to generate the cash they need to improve the carbon footprint of their operations. As such, they need to find a way to offset the amount of carbon they’re already emitting.

Let’s say two companies, Company 1 and Company 2, are only allowed to emit 400 tons of carbon. However, Company 1 is noton track to emit 600 tons of carbon this year, while Company 2 will only be emitting 200 tons. To avoid a penalty comprised of fines and extra taxes, Company 1 can make up for emitting 200 extra tons of CO2e by purchasing credits from Company 2, which has extra emissions room to spare due to producing 200 tons less carbon this year than they were allowed to.

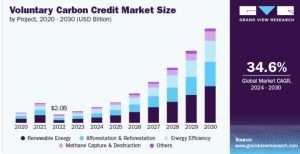

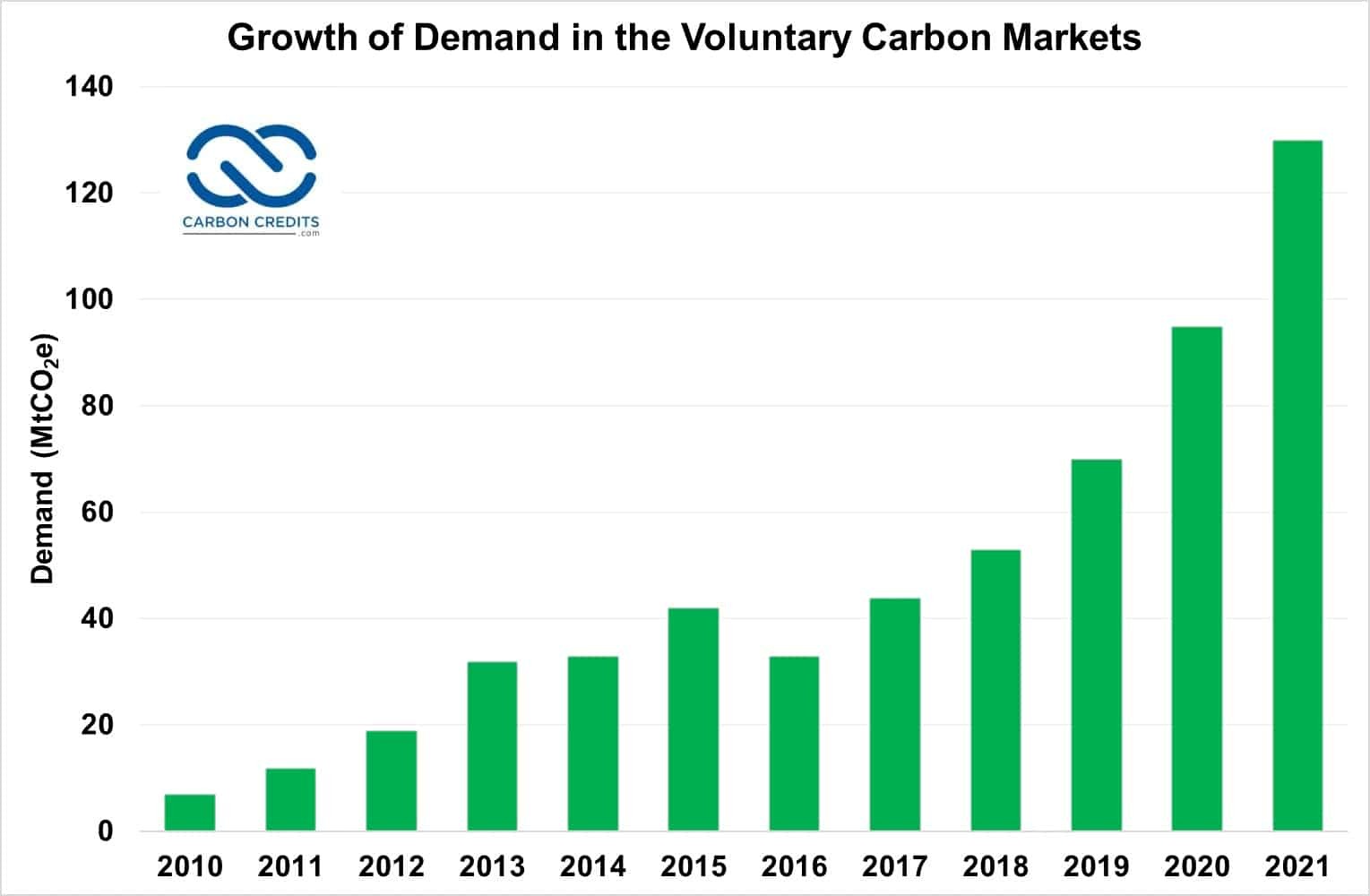

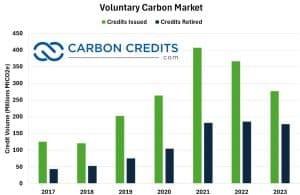

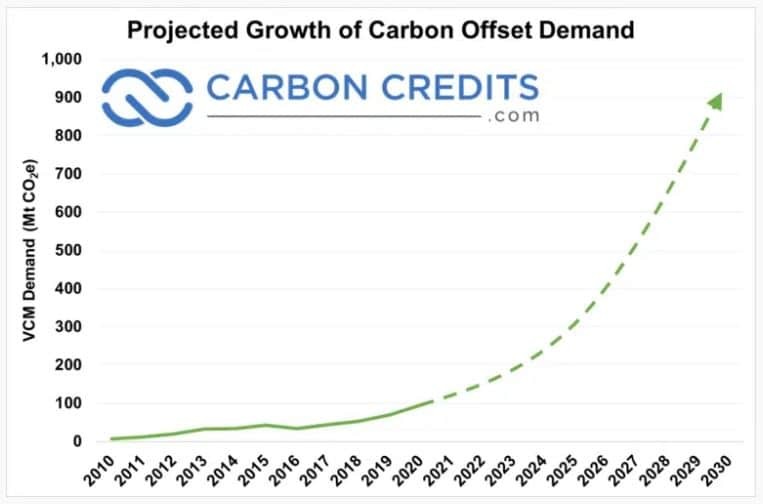

The voluntary carbon market reached a value of $2.5 billion in 2023 and is projected to grow to$100-250 billion by 2030, according to recent analyses.

How to Produce Carbon Credits?

Many different types of businesses can create and sell carbon credits by reducing, capturing, and storing emissions through different processes. Some of the most popular types of carbon offsetting projects include:

- Renewable energy projects,

- Improving energy efficiency,

- Carbon and methane capture and sequestration,

- Land use and reforestation.

Renewable energy projects have already existed long before carbon credit markets came into vogue. Many countries in the world are blessed with a natural wealth of renewable energy resources. Countries such as Brazil or Canada that have many lakes and rivers, or nations like Denmark and Germany with lots of windy regions. For countries like these, renewable energy was already an attractive and low-cost source of power generation, and they now provide the added benefit of carbon offset creation.

Energy efficiency improvements complement renewable energy projects by reducing the energy demands of current buildings and infrastructure. Even simple everyday changes like swapping your household lights from incandescent bulbs to LED ones can benefit the environment by reducing power consumption. On a larger scale, this can involve things like renovating buildings, optimizing industrial processes to make them more efficient, or distributing more efficient appliances to the needy.

Carbon and methane capture involves implementing practices that remove CO2 and methane (which is over 20 times more harmful to the environment than CO2) from the atmosphere. Methane is simpler to deal with, as it can simply be burned off to create CO2. While this sounds counterproductive at first, since methane is over 20 times more harmful to the atmosphere than CO2, converting one molecule of methane to one molecule of CO2 through combustion still reduces net emissions by more than 95%.

For carbon, capture often happens directly at the source, such as from chemical plants or power plants. While the injection of this captured carbon underground has been used for various purposes like enhanced oil recovery for decades already, the idea of storing this carbon long-term, treating it much like nuclear waste, is a newer concept.

Land use and reforestation projects use Mother Nature’s carbon sinks, the trees, and soil, to absorb carbon from the atmosphere. This includes protecting and restoring old forests, creating new forests, and soil management.

Plants convert CO2 from the atmosphere into organic matter through photosynthesis, which eventually ends up in the ground as dead plant matter. Once absorbed, the CO2-enriched soil helps restore the soil’s natural qualities—enhancing crop production while reducing pollution.

Who Verifies Carbon Credits?

The carbon credit verification landscape has evolved with new standards emerging. Beyond established verifiers like Verra and Gold Standard, the Integrity Council for the Voluntary Carbon Market (IC-VCM) launched its Core Carbon Principles in 2024, setting new global threshold standards for high-quality carbon credits.

Likewise, the Science Based Targets initiative (SBTi) has also introduced enhanced verification protocols for corporate net-zero claims.

How Companies Can Offset Carbon Emissions?

There are countless ways for companies to offset carbon emissions. Though not a comprehensive list, here are some popular practices that typically qualify as offset projects:

- Investing in renewable energyby funding wind, hydro, geothermal, and solar power generation projects, or switching to such power sources wherever possible.

- Improving energy efficiencyacross the world, for instance by providing more efficient cookstoves to those living in rural or more impoverished regions.

- Capturing carbonfrom the atmosphere and using it to create biofuel, makes it a carbon-neutral fuel source.

- Returning biomass to the soilas mulch after harvest instead of removing or burning. This practice reduces evaporation from the soil surface, which helps to preserve water. The biomass also helps feed soil microbes and earthworms, allowing nutrients to cycle and strengthen soil structure.

- Promoting forest re-growththrough tree-planting and reforestation projects.

- Switching to alternate fuel types, such as lower-carbon biofuels like corn and biomass-derived ethanol and biodiesel.

If you’re wondering how carbon offset and allotment levels are valued and determined through these processes, take a deep breath. Monitoring emissions and reductions can be a challenge for even the most experienced professional.

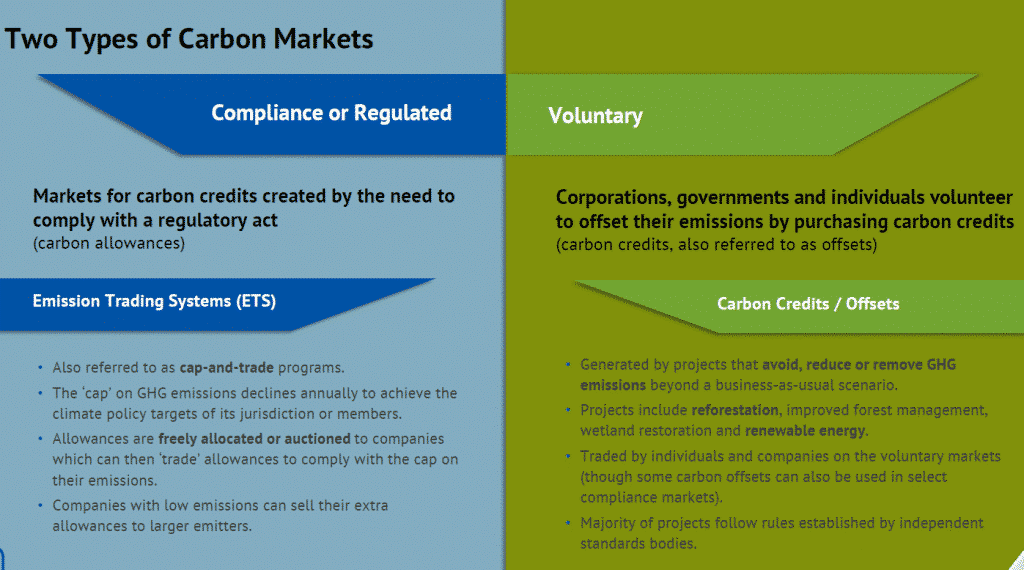

The Two Types of Global Carbon Markets: Voluntary and Compliance

There’s one more important distinction between carbon credits and carbon offsets:

- Carbon credits are generally transacted in the carbon compliance market.

- Carbon offsets are generally transacted in the voluntary carbon market.

Global Compliance Market

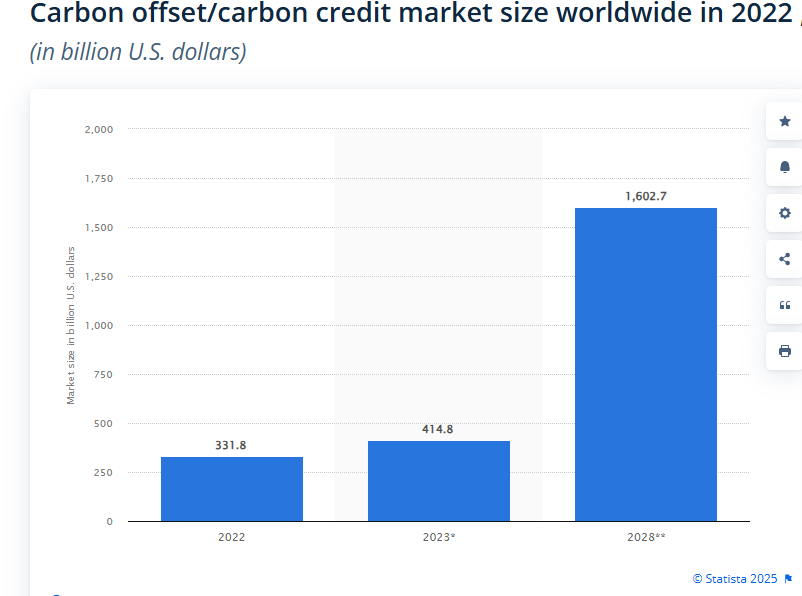

The global compliance market for carbon credits is massive. According to Refinitiv, the market has grown substantially, reaching a trading value of approximately $1.5 trillion in 2024, up from $950 billion in 2023. This represents about 15.7Gt CO2 equivalent traded across various compliance markets worldwide.

The European Union Emissions Trading System (EU ETS) remains the largest market, followed by China’s national ETS.

Source: Katusa Research, Refinitiv, LSEG

Mandatory schemes limiting the amount of greenhouse gases that can be emitted have proliferated—and with them, a fragmented carbon compliance market is developing. For example, the European Union has an Emissions Trading System (ETS) that enables companies to buy carbon credits from other companies.

California runs its own cap-and-trade program, and nine states on the eastern seaboard have formed their own cap-and-trade conglomerate, the Regional Greenhouse Gas Initiative.

Companies with low emissions can sell their extra allowances to larger emitters in a compliance market.

The Voluntary Carbon Market

The voluntary carbon market for offsets is smaller than the compliance market but is expected to grow much bigger in the coming years. It’s open to individuals, companies, and other organizations that want to reduce or eliminate their carbon footprint but are not necessarily required to by law.

Consumers can purchase offsets for emissions from a specific high-emission activity, such as a long flight, or buy offsets on a regular basis to eliminate their ongoing carbon footprint.

For example, our energy efficiency project in the Bangladeshi capital Dhakaenhanced existing natural gas networks, equipping engineers to detect and repair leaks of the potent greenhouse gas methane. They identified and repaired 37,000 leaks, saving enough gas to power a 119 MW power station.

The lifecycle of a carbon credit

Phase 1: Planning and designing the carbon project

Carbon credits begin with an idea for a project that will avoid or remove GHG emissions through nature-based solutions, health & livelihood interventions, or sustainable infrastructure. ExpoTech UK Limited will work with project developers to turn these ideas into a fully fleshed-out, formal Project Design Document (PDD) that can be registered with an internationally-recognized standard. This involves rigorous due diligence that assesses the project’s feasibility and risks, and ensures its benefits are real, measurable, additional, permanent and unique.

ExpoTech will help the project implementation partner to assess the baseline emissions that would occur in future if this project did not happen. This is critical, as the difference between the emissions after the project is implemented and the baseline will be the eventual measure of how much carbon was avoided or removed.

Bangladesh Government should carefully screen all project partners, and take the project through a thorough due diligence review to assess and environmental, delivery, political and reputational risks that might emerge. It is important at this stage to identify stakeholders who might be affected by the carbon project or whose support is necessary for it to succeed. PDB (Power Development Board) should comprehensively evaluate any additional benefits to these stakeholders and how they align with the UN’s 17 Sustainable Development Goals (SDGs).

Once the project design document is ready it should be audited by an independent third party—a Validation and Verification Body (VVB)—and a Standard to assess, validate, and verify the project under an approved methodology.

This simply means a scientifically robust approach to measuring emissions reductions. Bangladesh Government should have developed and lead-authored several of these already (I hope so), including the Gold Standard-approved methodology for assessing the impact of electric or metered cooking devices, since almost all parts of Bangladesh households are not getting the natural gas regularly for everyday cooking and most of people are buying induction oven or other electrical devices. Lastly, the project is registered to the Standard.

Depending on the project type, PDB may have to review their baselines and re-validate every few years

Phase 2: Developing and implementing the project

Quality carbon projects usually require funds in the millions of dollars. Increasingly corporate buyers are getting involved in carbon financing at this stage to back projects that might not otherwise have happened, and to secure commitments to the carbon credits to meet their future climate targets.

Once the project has been designed activity begins, such as planting trees for this Community Afforestation Project in India.

Phase 3: Carbon asset development

It takes considerable time to remove or avoid a tonne of CO2e emissions, but this is where the benefit gets felt.

How to Calculate Carbon Credits?

A carbon credit is a unit of exchange that individuals and firms alike use to offset their greenhouse gas (GHG) emissions. One carbon credit, or offset in the voluntary carbon market (VCM), is equal to one metric tonne of GHG reduced or avoided from entering the atmosphere. Carbon credits don’t have the same value. This is mainly because the carbon credit market, like any other voluntary markets, are not regulated. Different factors affect the final value or price of the credit.

How much the worth of each credit is determined by the following:

- Market dynamics or the supply and demand,

- project costs and location,

- and the project developer all impact how much is the worth of each credit. So the results of measuring and accounting for carbon credits can vary a lot, depending on those factors.

Accounting for carbon credits also varies for personal and business purposes. On the individual level, home energy use, travels, meals, and hotel stays are the key items to factor in when calculating emissions. For businesses, the entire value chain of the products or services offered must be taken into account. Plus, employees’ travel and commute.

The total tonnes of emissions calculated determine the amount of carbon credits we need to offset our footprint.

How Are Carbon Credits Calculated?

There are five easy steps to follow on how to calculate carbon credits we have to buy for offsetting emissions according to DEFRA.

It refers to the Department for Environment, Food and Rural Affairs in the UK and for Bangladesh, it the Bangladeshi Government which needs to decide. But in general, the steps for calculating carbon footprint to know the corresponding offsets are the same from country to country and here’s how to do that.

Step #1: Determine activities that emit GHGs

The first thing you should do is to identify activities you or your firm do that release GHGs.

The more complex the structure of your organization, the more difficult it is to identify who or what are the sources of emissions. But most often, doing it involves three different ways based on the following emissions scopes.

The following diagram shows the common types of emissions sources under each scope.

Identifying those activities under each of the 3 scopes will be helpful when targeting the emissions source for later reductions.

Who are the standards that issue carbon credits?

There are various internationally-recognized standards. We only work with those that have been endorsed by the trade body ICROA (International Carbon Reduction and Offset Alliance), which has established a Code of Best Practice for the industry.

These include:

- Verified Carbon Standard (VCS)

- Gold Standard

- The American Carbon Registry (ACR)

- Climate Action Reserve (CAR)

- Plan Vivo

- Woodland Carbon Code

These standards establish methodologies for different types of projects to lay out how they should calculate the emissions reductions or removals they are delivering, and what qualifies for the sale of carbon credits. They establish rules for monitoring, reporting, verification, assess and approve organizations that are qualified to act as independent auditors, and track the issuance and retirement of credits.

Step #2: Quantify polluting activities

The most common approach used to calculate GHG emissions is to apply emission factors to known activity data from our home or organization. This means getting the quantity of resource use through receipts, invoices, or bills associated with the activities. For instance, calculate the amount of electricity, fuels, goods, and services we paid for.

Activity data can be collected in different units of measurement.

- For example, weights in the case of food or volume for fuel used and kilowatt hours for electricity consumed.

- For water, we quantify emissions in cubic meters while it’s mileage for travel. The costs for each of these polluting activities should be monitored and summed up for each year.

- It is best to collect activity data by volume or mass (e.g. liters of petrol) as emissions can be measured more accurately.

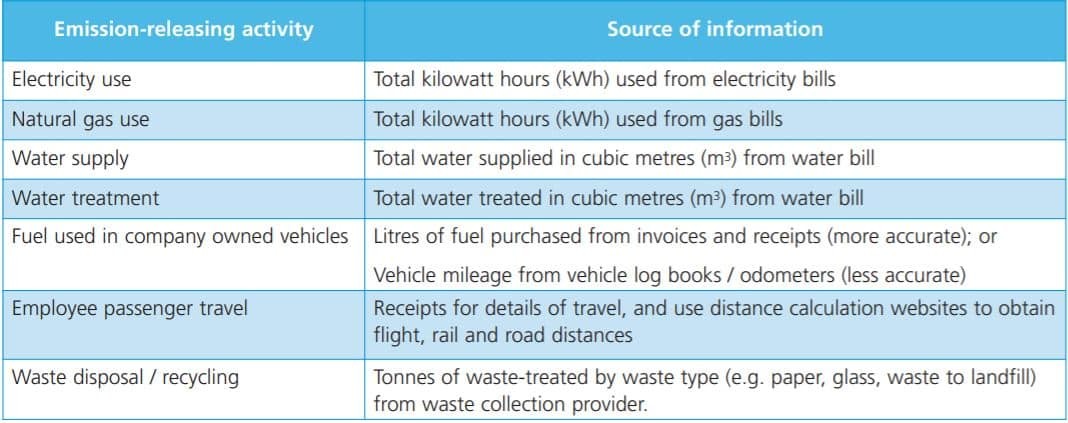

The table below sets out common polluting activities and sources of information to turn the data into GHG emissions.

And if it’s impossible for you to calculate emissions from known activity data, you can estimate. But be transparent of the estimation method used to ensure that results are reasonable.

Step #3: Get the emission factor of major GHGs

This is when things can be quite tricky when we calculate carbon credits. That’s because there’s a formula to get the emissions from all six major GHGs. But keep in mind that our reporting period should be for 12 months.

Our emissions year should also ideally correspond with our financial year. In case they’re different, most of our reporting year must fall within our financial year. Going back to the DEFRA guide, it notes that different activities or fuels also have different emission factors (EF). That’s to reflect how polluting each of the following GHGs is:

- Carbon dioxide (CO2),

- Methane (CH4),

- Nitrous oxide (N2O),

- Hydrofluorocarbons (HFCs),

- Perfluorocarbons (PFCs), and

- Sulfur hexafluoride (SF6).

Different activities and fuel can release one or more of them. So, it’s important that we know their corresponding EF. To calculate emissions of each GHG, here’s the formula to follow:

“Activity data x Emission factor = GHG emission”

Activity data refers to total use of a resource in a year. Multiplied that by the EF of all the GHGs generated by that certain activity and you get the emissions.

The Environment Protection Agency (EPA) Greenhouse Emission Inventories provide the EFs for various fuels/resources. These include coal and coke, biomass, electricity, fossil fuels, natural gas, and petroleum. We can also find the EF of GHGs per type of vehicle that you or your company use and corresponding year. The EPA also keeps a record of EFs for various industries called AP-42. It contains EFs of over 200 air pollution source categories, industry sectors or groups of similar emitting sources. Bangladesh should collect these types

of data. For the EFs of the foods and drinks we consume, we can find them in this Intergovernmental Panel on Climate Change (IPCC) Guidelines for National Greenhouse Gas Inventories.

Step #4: Change the EF to carbon dioxide equivalent

One crucial thing to take note is that the 6 major GHGs don’t have equal damage to the planet, also called their Global Warming Potential (GWP).

In other words, one unit of CO2, for instance, has a different warming effect than methane. It’s the same for the other GHGs.

Likewise, one unit of nitrous oxide has a GWP of 298 or equal to 298 units of CO2. It means N2O has the potential to warm the earth 298 times more than the same amount of CO2.

That’s why it’s important to convert emissions into CO2 equivalent (CO2e). To do this, multiply the EF of each GHG with its corresponding GWP.

Step #5: Compute total emissions

The last step left to do is to calculate the total emissions of our activities/resource use. Get it by summing up all emissions in CO2e for a year.

For personal emissions, there’s another way to get our carbon footprint. For instance, we can use an online calculator that can generate our total emissions after we provide all the information.

But if we prefer a manual calculation for our organization’s emissions, we can always follow the five easy steps mentioned.

Sample computation to calculate carbon credits

The steps serve as a guide on how carbon credits are calculated. To give us a clearer picture, here’s a sample calculation we can try:

It’s based on electricity use of a household with four persons living in the U.S. The basis is the known 2015 activity data.

Step 1: Electricity use is under Scope 1 emissions

Step 2: Average use of electricity by 1 person in the US is 4,517 kWh/year.

So, it means the household of 4 people uses about 18,068 kWh (kilowatt per hour). That is equal to around 18 MWh of electricity use. 1,000 kWh = 1 megawatt (MWh).

The next step is to calculate the emissions for the activity by getting its EF.

Step 3: Electricity use EF from the EPA Greenhouse Emission Inventories

Get the EFs for electricity from the EPA Greenhouse Emission Inventories. You’ll find three GHGs for this—CO2, CH4, and N2O. Here’s the corresponding EFs for each one of them:

CO2/MWh = 650.31 lbs

CH4/MWh = 0.03112 lbs

N2O/MWh = 0.00567 lbs

Following the formula provided earlier, multiply the 3 EFs above by 18 MWh of electricity used by the household of 4. The computation to calculate total emissions for a year goes as follows:

650.31 lbs (CO2) x 18 = 11,705.58 lbs of CO2

0.03112 lbs (CH4) x 18 = 0.56016 lbs of CH4

0.00567 lbs (N2O) x 18 = 0.10206 lbs of N2O

Step 4: Converted CO2e for CH4 and N2O

To express all the emissions in CO2e, multiply their GWP specified in the EPA Greenhouse Emission Inventories.

In this case, the methane (25) and nitrous oxide (298) GWPs as explained earlier. The calculation goes like this:

11,705.58 lbs of CO2 x 1 = 11,705.58 lbs of CO2e

0.56016 lbs of CH4 x 25 = 14.00 lbs of CO2e

0.10206 lbs of N2O x 298 = 30.41 lbs of CO2e

Step 5: Total emissions is 11,750 lbs of CO2e

Lastly, sum up all the 3 converted emissions from step 4 above. Then you’ll arrive at around 11,750 lbs of total CO2e emitted in a year for electricity consumption of 4 people.

Carbon emissions often come in tonnes. So 11,750 pounds is equal to about 5.33 tonnes of CO2e.

So, what does that figure mean to calculate the carbon credits you have to buy? It’s pretty simple. Just multiply the total emissions (5.33) with the price of carbon per tonne as per the market’s rate.

For example, if the carbon price in the market that we buy from is at US$15.0/tCO2e, that would be: 5.33 tCO2e x $15.0 = $79.95.

So, the family of four wanting to offset their emission due to electricity use can buy carbon credits worth $79.95. Or it can be lower depending on the certain market they’ll be buying from. That money is then spent on projects that reduce or avoid carbon from entering the atmosphere.

Accounting For Carbon Credits

High CO2emitting sectors like the energy, aviation, and automobile are under regulatory or compliance carbon credit schemes. It means they have to meet a certain limit on emissions set by a government regulatory framework.

This is also called the cap-and-trade scheme or Emissions Trading System (ETS). These systems create the Certified Emissions Reduction (CER) credits. Firms with excess CER credits can trade with others who are over their limits.

There are some key international accounting bodies for regulatory carbon credits after the Kyoto Protocol. But since there’s no regulatory guidance yet, some firms made their own emissions accounting policies. But most companies are accounting for their carbon credit transactions using the IASB’s IFRS.

We can also buy carbon credits from a voluntary carbon project, also known as carbon offsets. The steps involved when accounting for carbon credits under VCM are identical, but only without the regulatory approving bodies.

Still, a third-party entity must verify the carbon credits created by the project. This is to ensure that the amount of reductions they claim are verifiable and real or measurable.